This is one of several blogs in a series called Does Anybody Understand this stuff?, concerning economics and our future. There is no way to honor the blogging rule of 600 word posts when we are talking about the economy, so I will try to keep them short but no promises. I am not an economist, but as a serious student of cycles and history, I spend a lot of time trying to figure this all out. Below is a interesting discussion on deflation and Austrian Economics.

By the way, I think Austrian Economics are the only real answer even if this author doesn’t. Governments are notorious for expanding, prolonging and deepening economic problems either by trying to stretch their economic resources to engaging in more spending or by trying to diminish short term effects of natural economic cycling.

I WANT TO POINT OUT VERY STRONGLY HERE THAT THE ARTICLE BELOW IS BASED ON THE CONCEPT THAT A DEBT ECONOMY IS A GOOD THING. HE NEVER ADDRESSES WHAT WOULD HAPPEN IF THE GOVERNMENT STAYED OUT OF THE WAY, OR IF THE FEDERAL RESERVE WAS NOT IN CHARGE OF THE MONETARY SYSTEM, OR IF FAMILIES WERE MORE SELF-RELIANT. IT ALL DEPENDS ON WHETHER YOU ARE TRYING TO MAKE A CURRENT UNSUSTAINABLE SYSTEM WORK OR IF YOU ARE CONSIDERING ALTERNATIVES.

The only reason I have begun this series with this article is to give you a sense of the level of complication that has been brought to the economy as a means of convincing you to not even try to understand it. When you reach that level of frustration, just move on to Part Two.

I borrowed this discussion entirely from Furry Brown Dog

Austrian economics and the fallacy of deflation

Recently I’ve been engaged in an online discussion with Christopher Pang of the New Asia Republic here. Christopher wrote an article on some supposed economic myths and his attempts to debunk them. My comments on his stand and opinion may be read over there. Personally I feel that much of it is heterodox Austrian economics which is questionable theory. As I and another commentator Fox have said, Austrian economics conflates between consumer price inflation and monetary inflation, the former being a general increase in consumer prices but the latter being an increase in the money supply. But here I would like to address one particular claim, that deflation might be a good thing. This is a favourite talking point of Austrians which comes up quite often so it’s worth devoting an entire post to debunking that argument.

According to the Austrians, deflation is not necessarily a bad thing. Deflation is defined as a fall in the overall level of prices in the economy, generally a fall in the price of a consumer basket of goods/services tracked. Intuitively it may be a good thing because it helps to lower prices and wages until they become affordable again. This runs counter to what is normally understood in everyday conversational economics and introductory courses. Personally I am of the opinion that in general, falling prices across the board are a bad sign, but this statement requires some clarification and qualification.

To understand why deflation is normally thought of as being undesirable, here’s the standard explanation by Nobel Prize winning liberal economist Paul Krugman:

So first of all: when people expect falling prices, they become less willing to spend, and in particular less willing to borrow. After all, when prices are falling, just sitting on cash becomes an investment with a positive real yield – Japanese bank deposits are a really good deal compared with those in America — and anyone considering borrowing, even for a productive investment, has to take account of the fact that the loan will have to repaid in dollars that are worth more than the dollars you borrowed.

…

A second effect: even aside from expectations of future deflation, falling prices worsen the position of debtors, by increasing the real burden of their debts. Now, you might think this is a zero-sum affair, since creditors experience a corresponding gain. But as Irving Fisher pointed out long ago (pdf), debtors are likely to be forced to cut their spending when their debt burden rises, while creditors aren’t likely to increase their spending by the same amount.Finally, in a deflationary economy, wages as well as prices often have to fall – and it’s a fact of life that it’s very hard to cut nominal wages — there’s downward nominal wage rigidity. What this means is that in general economies don’t manage to have falling wages unless they also have mass unemployment, so that workers are desperate enough to accept those wage declines. See Estonia and Latvia, cases of.

Sounds persuasive right? But here’s what the Austrians say. They claim it isn’t bad when prices fall, because falling prices are observed in the computer and technology industry. While the personal computer used to costabout $3,000 in the US back in 1982, today’s Windows-compatible PC prices are typically much cheaper, at about $600 for the cheapest basic ones. The computer industry has gone from strength to strength and has experienced nothing of the kind of economic disaster so often warned about when prices decline.

Secondly, to quote from a Austrian rebuttal the world has seen falling prices, most notably during the Second Industrial Revolution during a period of economic prosperity:

For example, both the U.S. and Germany enjoyed very solid growth rates at the end of the 19th century, when the price level fell in both countries during more than two decades. In that period, money wage rates remained by and large stable, but incomes effectively increased in real terms because the same amount of money could buy ever more consumers’ goods. So beneficial was this deflationary period for the broad masses that it came to the first great crisis of socialist theory, which had predicted the exact opposite outcome of unbridled capitalism. Eduard Bernstein and other revisionists appeared and made the case for a modified socialism. Today we are in dire need of some revisionism too – deflation revisionism that is.

Is this really true? A commentator pointed out that prior to 1913 there was no CPI data for the US, so the claim can’t quite be verified using official statistics. Secondly what matters is that the fall in prices are prices tracked by the basket of consumer goods, rather than other goods which may not be purchased by consumers. But more importantly, the fatal flaw in the Austrian argument that deflation may be a positive thing lies in a failure to distinguish between different factors behind falling prices. While deflation is more commonly understood as falling prices it’s important to understand that two distinct economic causes can have the same effect. Economist Nouriel Roubini, one of the few economists to have accurately forecast the economic crisiselaborates why in a video here.

Deflation more than just falling prices

I don’t have a transcript but the point Roubini was making was that if falling prices are a consequence of technological advancement and increased productivity (as was the case during the 2nd Industrial Revolution), they are a good thing, but if they are due to the fact that consumers are holding off purchases because of declining wage levels or lost jobs (eg. Great Depression, Japan’s lost decade, America 2008-?), we have a negative situation. Why is this distinction important despite the fact that in both cases, falling prices are the consequence?

To understand this in introductory economics under the assumption of perfect competition, falling prices due to technological advancement and productivity corresponds to a right-ward shift of the supply curve of the goods market, whereas if deflation is the result of withheld consumer spending, this means that the demand curve shifts to the left, which also results in lower prices. Why should the former be beneficial to the economy while the latter be disastrous? I would argue the difference that matters is because in the former case, though prices are lower the cost of producing goods are lower as well. Unlike in the latter case where decreased consumer spending is depressing prices, there’s still an increase in output. By comparison, in the latter destructive case of falling prices, output falls unreservedly.

To take the widely cited example of the computer industry, even though computer prices have fallen drastically since thirty years ago, the total annual number of computers manufactured and sold have not fallen. Similarly, though I have not actually searched for data on this, it is likely that despite the fall in average unit prices of steel, industrial engines and other industrial produce have all increased in output. Contrast this with the great contraction in output as tracked by GDP during the Great Depression, and much of the Western world today and you’ll see that falling prices are typically not accompanied by huge increase in output whether measured in real or nominal terms. Instead, falling prices are seen together with rising unemployment, cuts in wages and declining GDP.

Hence we see from the above explanation that the Austrian rebuttal fails to take into account the broader economic picture. Falling prices are harmful if they also imply falling wages, which leads to decreased consumer spending, causing prices to fall again in a destructive spiral. See here also for a much better written article on the difference between the two and why deflation is bad.

Does this mean that the Austrians do not understand the difference between the two? I was about to conclude that way, but happen to chance upon an article by a popular Austrian website where the difference is clearly explained:

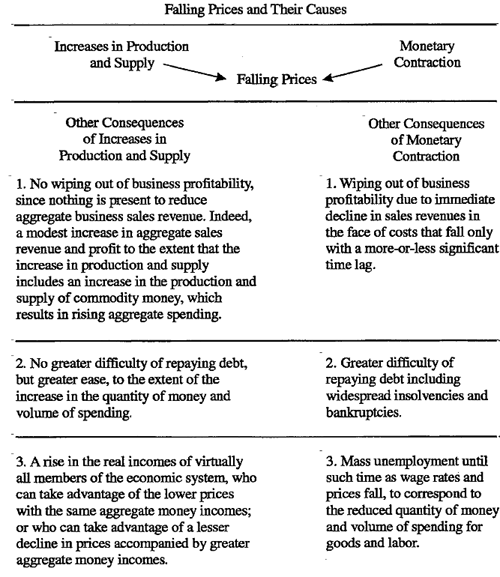

What needs to be realized is that there are two distinct causes of generally falling prices. One is the increase in production and supply, which should never, never be confused with deflation, depression, or poverty. The other is a decrease in the quantity of money and or volume of spending in the economic system. Falling prices is the only effect that they have in common. They differ profoundly with respect to their other effects.[1]

For example, if falling prices result from the fact that while the quantity of money and volume of spending in the economic system are rising at a two percent annual rate, production and supply are rising at a three percent annual rate, the average seller in the economic system is in the position of having three percent more goods to sell at prices that are only one percent lower. His sales revenues will be two percent higher, and that is what counts for his nominal profits and his ability to repay debts. His profits will be higher and his ability to repay debt will be greater. There are lower prices here, but absolutely no deflation.

What wipes out profits and makes debt repayment more difficult is not falling prices but monetary contraction, i.e., the reduction in the quantity of money and or volume of spending in the economic system. This is what serves to reduce sales revenues, and, in the face of costs determined on the basis of prior outlays of money, causes a corresponding reduction in profits. It is also what makes debt payment more difficult, in that there is simply less money available to be earned and thus available to be used for the repayment of debts. It is monetary contraction, and monetary contraction alone, which should be called deflation.

…

The case is different when the need for the fall in prices is caused by monetary contraction. In this case, the failure of prices to fall, in the face of the anticipation that they will fall, to the extent necessary to clear the market of unsold supplies of goods and labor, leads to a speculative postponement of purchases, which increases the pressure on prices to fall.

…

Deflation, which, it cannot be repeated too often, means monetary contraction, not falling prices, is at best in the category of a pain to be endured only in order to avoid greater pain later on. It should never be, and virtually never is, regarded as any kind of positive in its own right.

A few things to note. Unlike the quick and misleading rebuttal, the author acknowledges some key points about deflation in general. Namely, that falling price levels due to decreased spending will make debt much more difficult to repay (resulting in bankruptcies), that a deflationary spiral may result from it, that it’s traditionally accompanied by massive unemployment or cuts in working hours and pay. In other words, deflation should never be seen as a good thing but at best a necessary pain to be endured sooner so as to avoid even worse future economic suffering. In the end however, while there is much to commend the Austrian economics professor for acknowledging these crucial facts the economist also seems to think there should be some magical level prices would have to fall to before the economy can pick up again. As pointed out in a reply to Christopher, this is wishful thinking:

You are arguing from the perspective of an economy which is already at potential output. This is not the case for the US or much of Europe now. In the US, there are five unemployed persons to every job vacancy, which means that if every job vacancy is somehow miraculously filled 80% of the unemployment problem would still be there. The entire argument about crowding out works only when you have limited resources and when there is demand for it but right now there’s only slack. I hope you recognise that deflation is self-reinforcing, falling prices only make consumers hold back purchases in anticipation of further price declines; there isn’t any magical level prices would have to fall back to before firms and businesses suddenly decide to invest and hire. Inflation on the other hand, is what makes it unprofitable to sit on cash. Expectations of future inflation would make businesses and consumers do something with idle cash instead of just sitting on them. This is something Greg Mankiw pointed out in an op-ed last year. Raising inflation expectations sharply might be a way of jolting the moribund economy.

In other words, while Austrians assert that while prices have to fall, they have not told us explicitly how much prices have to decline before the economy picks up again. For example, prices in Japan today are actually lower than they are in 1989 (a somewhat amazing fact once you consider that every other part of the world has only seen higher prices), and in return Austrians have claimed that the reason why Japan hasn’t boomed is because prices haven’t fallen enough yet. At the moment, Christopher has yet to address most of the rebuttals made to his replies. It’s somewhat regrettable to see that New Asia Republic host articles such as Christopher Pang’s economic myths which themselves are really nothing more than unsubstantiated and debunked economic fallacies. At the same time they’re a good thing because it forces laypersons such as us to clarify and nail down exactly what is meant and implied when we use certain terms such as inflation/deflation.

Update: To be fair to Christopher, I realise that it’s more accurate to say that he hasn’t addressed the arguments yet rather than because he doesn’t bother to. My apologies to Christopher for sounding extremely rude and discourteous.

Do the Austrians offer any lessons?

Now despite what I’ve written above many will continue to point to the fact that the Austrians have a good explanation of recession busts and economic booms, the Austrian business cycle theory. These same folks are fond of pointing out that the monetarists and (Neo/Post/New)-Keynesians on the other hand can’t explain why booms and busts occur. While I agree that contemporary economics (though be warned that as a layperson I might be completely mistaken) can’t explain why both booms and busts occur, the idea behind a credit surge and bust coupled with speculation and market irrationality isn’t unique to Austrian economics. As Professor Krugman explains in a new Voxeu.org paper, non-Austrian economist Hyman Minsky spent much of his professional life developing theories of speculative bubbles, credit models linked with financial instability; which sounds much like what we’ve seen the past few years:

The current preoccupation with debt harks back to a long tradition in economic analysis, from Fisher’s (1933) theory of debt deflation to Minsky’s (1986) back-in-vogue work on financial instability to Koo’s (2008) concept of balance-sheet recessions. Yet despite the prominence of debt in popular discussion of our current economic difficulties and the long tradition of invoking debt as a key factor in major economic contractions, there is a surprising lack of models – especially models of monetary and fiscal policy – of economic policy that correspond at all closely to the concerns about debt that dominate practical discourse.

…

We envision an economy very much along the lines of standard New Keynesian models – but instead of thinking in terms of a representative agent, we imagine that there are two kinds of people, “patient” and “impatient”; the impatient borrow from the patient. There is, however, a limit on any individual’s debt, implicitly set by views about how much leverage is safe.

We can then model a crisis like the one we now face as the result of a “deleveraging shock.” For whatever reason, there is a sudden downward revision of acceptable debt levels – a “Minsky moment.” This forces debtors to sharply reduce their spending. If the economy is to avoid a slump, other agents must be induced to spend more, say by a fall in interest rates. But if the deleveraging shock is severe enough, even a zero interest rate may not be low enough. So a large deleveraging shock can easily push the economy into a liquidity trap.

Krugman wasn’t alone in noticing that Minsky’s work of the 1960s and 1970s offered a promising non-Austrian theoretical framework from which more rigorous and prescriptive economic theories and policies may be formulated. Both Tyler Cowen and Rajiv Sethi have acknowledged this as well. In addition Krugman has an additional post on that here.

In addition I argue that although it is admissible that current prevailing economic orthodoxy does not offer good theoretical and model explanations of the causes of the economic crisis as well as recommendations, Austrian economics does not appear to be the way forward. At the heart of Austrian theory lies the assumption that the free markets must be allowed to work their magic, outside of any form of government interference whether it be the open market operations of the central bank or any fiscal policy apart from cutting taxes. Minsky’s theories on the other hand, centre around an explicit distrust of the efficiency of the free markets which he characterises as the “financial instability hypothesis”, arguing that left unchecked, financial institutions are no more rational than gambling dens driven by Keynesian “animal spirits”, in stark contrast with the efficient market hypothesis:

Minsky’s model of the credit system, which he dubbed the “financial instability hypothesis” (FIH),[5]incorporated many ideas already circulated by John Stuart Mill, Alfred Marshall, Knut WicksellandIrving Fisher.[6] “A fundamental characteristic of our economy,” Minsky wrote in 1974, “is that the financial system swings between robustness and fragility and these swings are an integral part of the process that generates business cycles.”[7]

Disagreeing with many mainstream economists of the day, he argued that these swings, and the booms and busts that can accompany them, are inevitable in a so-called free market economy – unless government steps in to control them, through regulation, central bank action and other tools. Such mechanisms did in fact come into existence in response to crises such as the Panic of 1907and the Great Depression. Minsky opposed the deregulation that characterized the 1980s.

Personally I would say ignore the Austrians. Once upon a time it could be said the Austrians were ahead of everyone else in economics when they came up with their business cycle theories in the 1920s, but that was then. They have not progressed in any way since then. On this point John Quiggin has an excellent post on an overview of Austrian theory and why it shouldn’t be taken seriously here.

25 Responses

Uhhh I got it. The small picture good, the big picture bad!

Willard,

It depends how prepared and open-minded one is.

People really aren’t educated enough to look at all the dynamics. Its just how does this effect me. If a fallacy sounds good and I like that myth ( the civil war was about slavery ) then I can feel warm and fuzzy about it, or righteous about it, or get all revolution NOW about it. When I start to see the dynamics if I don’t get angry or overwhelmed it becomes clear that it takes real character and principle to fix this stuff. And where are character and principle today?

You definitely should have kept this to under 600 words. It was really hard to endure reading this. Nor do I feel more enlightened after reading it.

The bottom line is this. Should an organisation artificially attempt to control prices by monkeying with the supply of money? Or, Should the money supply be kept constant or fixed?

That is the real issue. Once you take a stand to that question then the debate can start.

Matt,

As I am hoping this becomes one of the meatier blogs out here. I will trust that readers will pay the price (as you did) to stay focused long enough to read more than 600 words before becoming bored.

Austrian Economics are more about a study of human nature than money supply or the economy. Some the economic laws they stand by are:

1. Choice determines all human action.

2. When man chooses, he chooses between material things, services and values.

3. Human action is purposeful behavior.

5. Action is the attempt to change one state of being for a state that is more

satisfactory.

6. Action always involves incentive or a good reason.

7. Only the individual can define what gives him satisfaction.

8. No person will act unless he thinks it will increase his satisfaction.

18. Man has a scale of need with which he prioritizes needs and value.

19. Most men’s scales of needs are similar but not identical.

20. When needs or values differ between people it is likely they will engage in an

exchange.

24. Mathematics is useless in predicting human behavior.

25. The Law of Marginal Utility: each individual portion of an item yields less

satisfaction.

26. The Law of Diminishing Returns: each additional portion of an item yields

less satisfaction.

27. Society occurs naturally when individuals seek satisfaction from or with each

other; and cooperation occurs only when society seeks satisfaction from or

with each other.

28. Society formed by any other means will cause dissatisfaction and humans

will seek to improve satisfaction by improving society.

29. Individuals seek cooperation naturally because they are different, therefore

division of labor, specialization and trade are natural and allow men to seek

greater satisfaction.

34. There are only two possible social arrangements, (1) voluntary cooperation and (2) forceful manipulation.

35. Only imaginary constructions based on laws can accurately predict the future.

40. Entrepreneurs drive the economy and nothing can take their place.

41. Consumer wants are the greatest influencing factor on entrepreneurs.

42. The only factors affecting the market are the purposeful acts of mankind.

43. Actions designed to increase the satisfaction of one tend to increase the

satisfaction of all.

44. The only way to deter the actions that decrease the satisfaction of others is to

make it painful.

45. Human beings naturally organize into factions and factions naturally

compete and have conflict with each other.

46. Human beings want to be different, and unequal, and to gain more than

others if they do more.

47. Human conflict is caused by opposition or by human conflict between

factions.

48. Government intervention causes this conflict to be violent; if government

only protects property then all other conflicts will tend to be equal.

49. Laws only work in a society if supported by public opinion.

50. Human action never brings full satisfaction, as soon as one want is satisfied another springs up.

It is a very different study and required first of all for us to be responsible for our own economic realities, and secondly to hold our leaders accountable.

This is wonderful, I have been trying to track down this list of Mises laws for years. They are so relevant. Thank you for posting them.

Shannon, this comment was a lot more understandable and informative then the blog you quoted from. Why not lead off with fundamental like this?

(I limited this to under 600, rather I crammed it into under 600, sorry for the undeveloped thoughts)

Perhaps there is a bottomer line, like what is the goal? If growth is the goal then inflation is good and deflation is bad. The blog starts from the assumption that growth is good, this is the basic assumption of most current economic discussion.

One way to handle this assumption is to ask if it’s true, is growth good? It depends, right? Growth is good in the case of an embryo, it is bad in the case of cancer.

Another approach is to ask who is growth good for? The blog mentions the fact that inflation is good for debtors, and then as in any pro-inflation discussion discusses workers, impressing on our minds the plight of the average American, and how with deflation his debts would be harder to repay. It’s true, inflation is good for a guy who has a $200,000 mortgage, but it’s even better for a corporate giant with a $200,000,000 business loan. Inflation is good for everyone with debt, it’s just better for those with lots of debt. The wealthy have way more debt than the poor. Inflation is way better for the wealthy than for the poor. Inflation increases income inequality, the gap between rich and poor.

And who is inflation best for? Well, who are the biggest debtors? BANKS. Everything banks have is borrowed, and is lent to the banks by everyone else. Banks are net borrowers and the rest of society are the lenders. If inflation helps borrowers and hurts lenders then inflation helps banks and hurts everyone else. Of course those at the top of everyone else know how to pass most, if not all of the cost onto those lower down. As much as possible, the wealthy play banker and stay as leveraged as possible.

Deflation does the opposite. It does slow growth, and it favors lenders or net savers. It also narrows the gap between rich and poor. It never gets rid of the gap, it doesn’t equalize income, producers still come out ahead of consumers. What it does is promote saving, self-sufficiency, and freedom. A person is free to work as an employee or run a small boot-strap business and live a modest life without being driven into the ground by rising prices.

The benefits of inflation go from the top down, firms and banks get to spend the money before prices increase. The benefits of deflation go from the bottom up, households get paid for their production before prices decrease. Producers are also consumers, their households are benefitted by deflation even if there businesses are not as much so. Consumers are not necessarily producers and so only get household benefits of inflation after producers/firms have gotten theirs. Deflation benefits the majority, inflation benefits the minority.

Economics says that the goal of firms is profit and the goal of households is utility/happiness. America is founded on the principle that governments are instituted to protect life, liberty and the pursuit of happiness (utility), not life, liberty, and the pursuit of profit. We have bought the idea that firms drive the economy and our government puts firms ahead of households. In reality, households drive the economy and they are who the government in its proper role is instituted to protect.

Joseph,

Well said. A study of the Ancient Hebrew economic system would find a lot of agreement with your comment.

Yeah, their system was beautiful. The prosperity of their posterity throughout history is a credit to their system.

You can find a great do-it-yourself online Austrian Economics course here: http://www.tomwoods.com/learn-austrian-economics/

You may want to read this article “Economic Depressions:

Their Cause and Cure,” by Murray Rothbard. Deflation is considered a “good” thing because it is correcting the tampering from the government that has already taken place in the economy. http://mises.org/tradcycl/econdepr.asp Here are some quotes:

“the business cycle is brought about, not by any mysterious failings of the free market economy, but quite the opposite: By systematic intervention by government in the market process. Government intervention brings about bank expansion and inflation, and, when the inflation comes to an end, the subsequent depression-adjustment comes into play.”

“how is it that booms can go on for years without having their unsound investments revealed, their errors due to tampering with market signals become evident, and the depression-adjustment process begins its work? The answer is that booms would be very short lived if the bank credit expansion and subsequent pushing of the rate of interest below the free market level were a one-shot affair. But the point is that the credit expansion is not one-shot; it proceeds on and on, never giving consumers the chance to reestablish their preferred proportions of consumption and saving, never allowing the rise in costs in the capital goods industries to catch up to the inflationary rise in prices. Like the repeated doping of a horse, the boom is kept on its way and ahead of its inevitable comeuppance, by repeated doses of the stimulant of bank credit. It is only when bank credit expansion must finally stop, either because the banks are getting into a shaky condition or because the public begins to balk at the continuing inflation, that retribution finally catches up with the boom. As soon as credit expansion stops, then the piper must be paid, and the inevitable readjustments liquidate the unsound over-investments of the boom, with the reassertion of a greater proportionate emphasis on consumers’ goods production.”

Mises, then, pinpoints the blame for the cycle on inflationary bank credit expansion propelled by the intervention of government and its central bank. What does Mises say should be done, say by government, once the depression arrives? What is the governmental role in the cure of depression? In the first place, government must cease inflating as soon as possible. It is true that this will, inevitably, bring the inflationary boom abruptly to an end, and commence the inevitable recession or depression. But the longer the government waits for this, the worse the necessary readjustments will have to be. The sooner the depression-readjustment is gotten over with, the better. This means, also, that the government must never try to prop up unsound business situations; it must never bail out or lend money to business firms in trouble. Doing this will simply prolong the agony and convert a sharp and quick depression phase into a lingering and chronic disease. The government must never try to prop up wage rates or prices of producers’ goods; doing so will prolong and delay indefinitely the completion of the depression-adjustment process; it will cause indefinite and prolonged depression and mass unemployment in the vital capital goods industries. The government must not try to inflate again, in order to get out of the depression. For even if this reinflation succeeds, it will only sow greater trouble later on. The government must do nothing to encourage consumption, and it must not increase its own expenditures, for this will further increase the social consumption/investment ratio. In fact, cutting the government budget will improve the ratio. What the economy needs is not more consumption spending but more saving, in order to validate some of the excessive investments of the boom.

Thus, what the government should do, according to the Misesian analysis of the depression, is absolutely nothing. It should, from the point of view of economic health and ending the depression as quickly as possible, maintain a strict hands off, “laissez-faire” policy. Anything it does will delay and obstruct the adjustment process of the market; the less it does, the more rapidly will the market adjustment process do its work, and sound economic recovery ensue.

The Misesian prescription is thus the exact opposite of the Keynesian: It is for the government to keep absolute hands off the economy and to confine itself to stopping its own inflation and to cutting its own budget.

It has today been completely forgotten, even among economists, that the Misesian explanation and analysis of the depression gained great headway precisely during the Great Depression of the 1930s?the very depression that is always held up to advocates of the free market economy as the greatest single and catastrophic failure of laissez-faire capitalism. It was no such thing. 1929 was made inevitable by the vast bank credit expansion throughout the Western world during the 1920s: A policy deliberately adopted by the Western governments, and most importantly by the Federal Reserve System in the United States. It was made possible by the failure of the Western world to return to a genuine gold standard after World War I, and thus allowing more room for inflationary policies by government.”

Thanks, guys! This is a lot for me to chew on, but economics is probably a good introduction to my diet. (This is more substantial than the coke and candy bars we talked about in Econ 101 when we discussed supply and demand.) Joseph, loved your thoughts, even if they were crammed in…

Melissa,

Try this on for size. The boom and bust cycle is not random. It is actually a 39-40 year cycle. About half of the time increasing to a peak and the other half declining to a low.

The 1940’s experienced a poor economy. By 1960, the economy was peaking, but by 1980 it was back in a slump. But by 2000, we were experiencing an amazing recovery and predictably in 2011 we are well into a decline.

Now compare this cycle to Generational cycles, and it becomes very clear.

The Baby Boomer generation was approximately 1945-1962. There is a peak spending lag of 46 years. So add 46 years and you will land right in the middle of 2008 and one of the biggest booms on American history. That’s what happens when 76.7 million men and women are in their greatest spending years. But when they hit 50 they change their spending habits and it is no surprise that the economy tanks.

The 39-40 year Boom and Bust cycle and the 46 year Generational cycle spending lag both point to a declining economy for the next 15 to 20 years.

This generational stuff is called Demographics Studies and they are vital to predicting economic trends. When 70% of our national economic activity is consumer spending, we have to realize that consumer spending drives the economy and 42-50 year olds spend more than any other group. That group (76.7 million strong) completely slowed their spending over the last 3 years, and they will not resume that kind of spending in their life time.

Based on demographics and the historical boom and bust cycle, the Echo Boomers will reach their peak spending in 2046 or so, and like magic we will see a major boom in the 10 years preceding 2046.

I recommend two books:

The Fourth Turning – Strauss and Howe

The Great Crash Ahead – Dent

Saw your link to my article. I am glad after so long someone still reads my stuff. I have Dent’s book but i think it is an updated version of his previous book, which is the one you recommend. I have The Great Depression Ahead.

The 50 laws are pretty useful also.

Thanks for engaging in the discusion. People need to spend more time thinking about this stuff.

Our goals are to 1 excavate the truth behind important issues and claims, and 2 to hold those responsible behind specific claims, and their leaders, accountable.

Let’s keep up the good work.

It has never made sence to create money out of thin air and build debts for our grandchildren to pay off. Its much like debtors prison in the old days. A bondage of sorts.

When I leave this world I hope to leave everything FREE and Clear for my family. Debts would leave them enslaved.

Gene F. Danforth